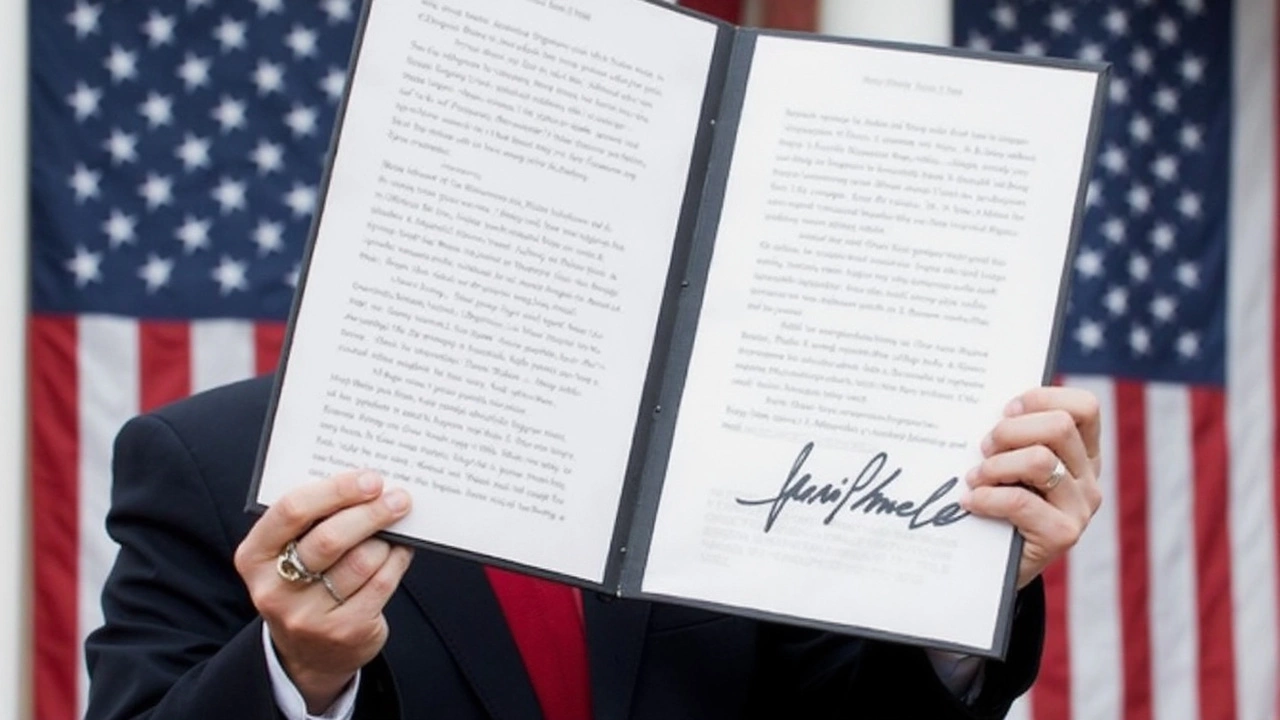

President Trump Unveils 'Liberation Day' Tariff Plan

Donald Trump has announced a significant adjustment to global trade dynamics by introducing a new wave of tariffs that will take effect on April 9, 2025. Spanning over 150 countries, these tariffs have been dubbed 'Liberation Day' by Trump, carrying implications that have sparked a mix of anticipation and concern worldwide.

The tariffs vary significantly, with Venezuela facing a 15% rate and Sri Lanka at the top with 44%. Notable countries such as India (27%), Indonesia (32%), Japan (24%), South Korea (26%), and Vietnam with the highest at 46% for reciprocal tariffs, are all affected. These measures also threaten to impose tariffs around 25% on Vietnam if certain conditions aren't met.

Domino Effect on Global and Domestic Markets

These changes echo the policies from Trump's first term, which saw a one-third reduction in steel imports and helped ignite $10 billion in domestic investments. Interestingly, an analysis made in 2024 estimated that a 10% global tariff could bolster the U.S. economy by $728 billion, generate 2.8 million jobs, and enhance household incomes by 5.7%.

Despite critics initially cautioning about potential trade wars reported by outlets like PBS and NPR in 2018, later evaluations by The Hill and S&P Global portrayed improved credit conditions for American steel and aluminum producers. This trend is visible in the actions of companies like Nucor and U.S. Steel, whose investments soared from $1.5 billion to $4.2 billion between 2017 and 2019.

The administration's intent is to combat what it terms as unfair global trade practices while safeguarding American industries. Advocates argue that this could mean job creation and a reduced dependence on foreign metals. Critics, however, fear possible disruptions to international supply chains and a backlash from affected countries.

Countries including Singapore, Spain, and Turkey—particularly linked to Venezuelan oil purchases—are also under scrutiny with potential tariffs on the horizon. The broader global implications of this policy shift will undoubtedly continue to be a subject of intense scrutiny as both supporters and opponents observe the unfolding economic landscape.