Business News & Insights – Latest Updates

Looking for the most useful business headlines without the fluff? Below you’ll find short, clear snapshots of today’s biggest market moves, stock stories, and investment trends. Each bite‑size piece gives you the facts you need to stay ahead.

Top Market Moves

Oracle’s stock surged 40% after a bullish growth forecast, pushing chairman Larry Ellison’s net worth past $393 billion. That jump added a record $101 billion to his fortune in a single day, overtaking Elon Musk for a brief moment.

On the other side of the world, U.S. stock futures fell sharply when China slapped new tariffs on American goods. The trade friction sparked fears of a broader recession and sent investors scrambling for safe assets.

Nickel prices have been in the spotlight as miners shut down and supply chains faced disruptions in New Caledonia. Analysts are split – some see a short‑term bounce, while others warn of a possible oversupply later this year.

In the drinks sector, Diageo’s fair‑value estimates vary widely after a dip in earnings per share and a tough foreign‑exchange environment. While some analysts spot upside potential, the overall outlook remains cautious.

Entrepreneurship & Investments

Deborah Meaden, the veteran Dragon from “Dragons’ Den”, has invested over £6 million in sustainable businesses. From whiteboard tech to eco‑friendly fashion, her portfolio shows a clear focus on green growth.

Ryan Smith, owner of the Utah Jazz, launched a $1 billion fund called HX One LP to back sports‑tech startups. The fund will use the Jazz as a testing ground for innovations in digital media, payments, and health wellness.

Across the Atlantic, Africa’s hospitality sector is booming. Big chains like Hilton and Marriott are driving a 13% rise in hotel development, especially in North Africa, while Sub‑Saharan markets catch up with new resorts and franchise models.

On the retail front, Tesco’s meal‑deal price rose to £3.85 with a Clubcard and £4.25 without. The change puts the deal slightly above rivals but still cheaper than many convenience stores.

All these stories point to a dynamic business landscape where tech, trade, and sustainability intersect. Keep checking back for fresh updates, and use these quick summaries to make informed decisions without wading through long reports.

Larry Ellison tops world's richest with $393B as Oracle stock soars 40%

Posted by Daxton LeMans On 11 Sep, 2025 Comments (0)

Oracle chairman Larry Ellison is now the world’s richest person at $393 billion after a 40% surge in Oracle shares on a bullish growth forecast. The spike added a record $101 billion to his fortune in one day, edging past Elon Musk at $385 billion, per Bloomberg. Ellison holds roughly 1.16 billion Oracle shares and remains the company’s CTO and executive chairman.

Tesco meal deal price rises again to £3.85 with Clubcard, £4.25 without

Posted by Daxton LeMans On 26 Aug, 2025 Comments (0)

Tesco has raised meal deal prices by 25p from August 21, 2025. The standard deal is now £3.85 with a Clubcard and £4.25 without, while the premium option rises to £5.50 and £6. Tesco says the deal still offers strong value and millions of combinations, but it’s now pricier than rivals like Sainsbury’s, Morrisons and the Co-op, though still cheaper than Boots.

Diageo Stock: Fair Value Estimates Spark Debate Amid EPS Declines and Market Headwinds

Posted by Daxton LeMans On 6 Aug, 2025 Comments (0)

Diageo’s recent fair value estimates range widely, reflecting mixed financial performance in 2025 and ongoing market challenges. Despite a sharp drop in earnings per share and forex issues impacting net sales, analysts see potential upside, though growth projections have softened.

Africa’s Hospitality Sector Booms as Major Hotel Chains Fuel Record Growth in 2025

Posted by Daxton LeMans On 16 Jul, 2025 Comments (0)

Africa’s hotel industry is booming in 2025 with a 13% surge in development, led by big chains like Hilton and Marriott. North Africa is at the center, but Sub-Saharan Africa is catching up, especially with new resorts. A wave of franchise models and recovering markets make this growth possible.

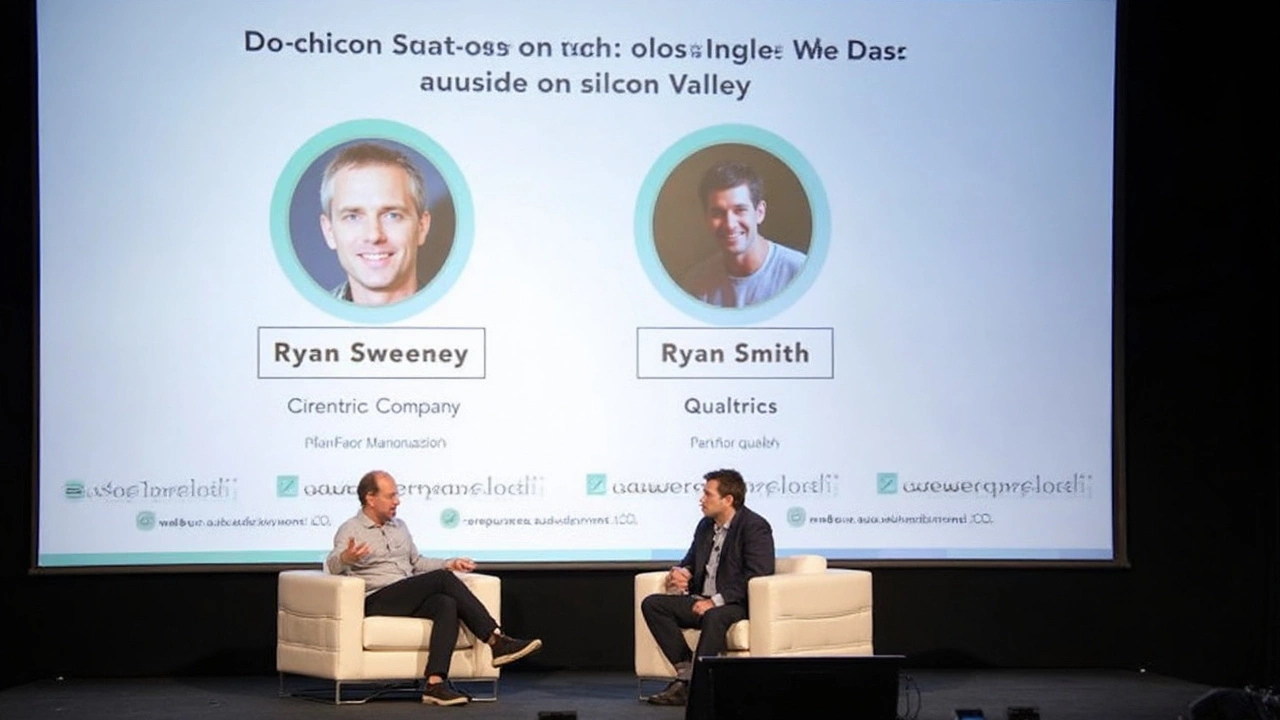

Utah Jazz Owner Ryan Smith Unveils $1 Billion Fund Targeting Sports-Tech Startups

Posted by Daxton LeMans On 20 May, 2025 Comments (0)

Utah Jazz owner Ryan Smith teams up with Accel’s Ryan Sweeney to launch HX One LP, a $1 billion investment fund aimed at growth-stage tech startups in sports and entertainment. Their strategy uses Smith’s teams as innovation labs and focuses on booming sports-tech sectors like digital media, payments, and health wellness.

US Stock Futures Dive as China Hits Back with Tariffs Amid Escalating Trade War

Posted by Daxton LeMans On 10 Apr, 2025 Comments (0)

On April 9, 2025, US stock futures took a steep dive as China's counter tariffs heightened trade tensions. This move followed Trump's hefty tariffs on Chinese imports, stirring fears of a looming US recession. As Beijing retaliated, restrictions expanded on American companies, intensifying anxieties over global economic disruptions.

Nickel Price Surge: A Genuine Boom or Just a Temporary Glitch?

Posted by Daxton LeMans On 9 Apr, 2025 Comments (0)

Nickel's recent price surge fuels debate over its sustainability, driven by mine closures and disruptions in New Caledonia. Analysts remain cautious, weighing short-term supply issues against long-term risks like potential oversupply and dwindling demand. Attention is focused on production stability and market conditions to decipher nickel's future trajectory.

From Dragons’ Den to Business Triumphs: Deborah Meaden's Remarkable Investment Journey

Posted by Daxton LeMans On 10 Mar, 2025 Comments (0)

Deborah Meaden, a stalwart of Dragons’ Den since 2006, has directed over £6 million into innovative ventures with an emphasis on sustainability. Celebrated for her frank style and environmental savvy, Meaden has backed successful businesses like Magic Whiteboard and Hope and Ivy while navigating the complexities of failed and liquidated ventures. Her role goes beyond finance, offering invaluable mentorship to budding entrepreneurs.