Market Reaction: Why Today's Headlines Matter to Your Wallet and Your Interests

Every morning you scroll through the news and see everything from tech billionaires hitting new highs to football clubs dropping record fees. Those stories aren’t just gossip—they’re signals that can move markets, shift fan sentiment, and even change your buying decisions. Understanding how and why markets react helps you stay ahead, whether you’re watching the stock ticker or the transfer table.

Big Numbers, Bigger Moves

Take Larry Ellison’s recent surge as an example. When Oracle shares jumped 40%, his net worth shot up by $101 billion in a single day. That kind of jump sends ripples through the tech sector, lifts related stocks, and fuels investor optimism. Traders watch these spikes to gauge market confidence and adjust portfolios quickly.

Football transfers work the same way. Liverpool’s £125 million buy‑out for Alexander Isak set a new British record. Not only did Liverpool fans buzz about the signing, but other clubs also felt pressure to raise offers for their own targets. Transfer fees can act like a price index for the sport, influencing sponsorship deals and even merchandise sales.

Pop Culture and Social Signals

Celebrity news can trigger market reaction too. When Zara McDermott posted LA photos that got a boost from Louis Tomlinson’s sisters, social media engagement spiked. Brands monitor that kind of buzz to decide where to place ads or launch new products. A viral moment can translate into a short‑term sales lift for fashion labels or streaming platforms.

Even movie trailers matter. The teaser for the new “Wuthering Heights” starring Margot Robbie generated millions of views, and studios used those numbers to predict opening‑week box office. Investors in entertainment stocks keep an eye on such metrics to estimate future earnings.

Sports betting markets react instantly to game updates as well. When Liam Lawson’s Red Bull stint turned into a solid run with Racing Bulls, odds on his future performances shifted dramatically. Bettors and bookmakers adjust lines based on the latest performance data, showing how real‑time results feed market prices.

So, what’s the practical takeaway? Look for three cues when you see a headline:

- Magnitude: How big is the change? A 40% stock surge or a record‑breaking transfer fee will have a larger ripple effect.

- Timing: Immediate reactions happen in minutes—think live sports scores or breaking financial news.

- Cross‑industry links: A tech boom can boost related sectors; a popular film can lift streaming stocks.

By watching these patterns, you can spot opportunities before they become mainstream. Whether you’re tweaking a stock watchlist, deciding on a fantasy football pick, or simply staying informed, paying attention to market reaction gives you an edge.

Remember, markets aren’t random—they’re a reflection of what people think, feel, and act on. The next time you read about a billionaire’s net‑worth jump or a club’s new signing, ask yourself: what will this do to the larger market? The answer often reveals the next move you should make.

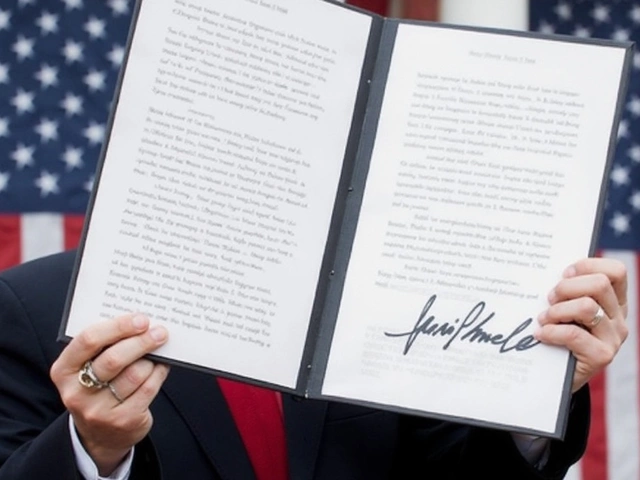

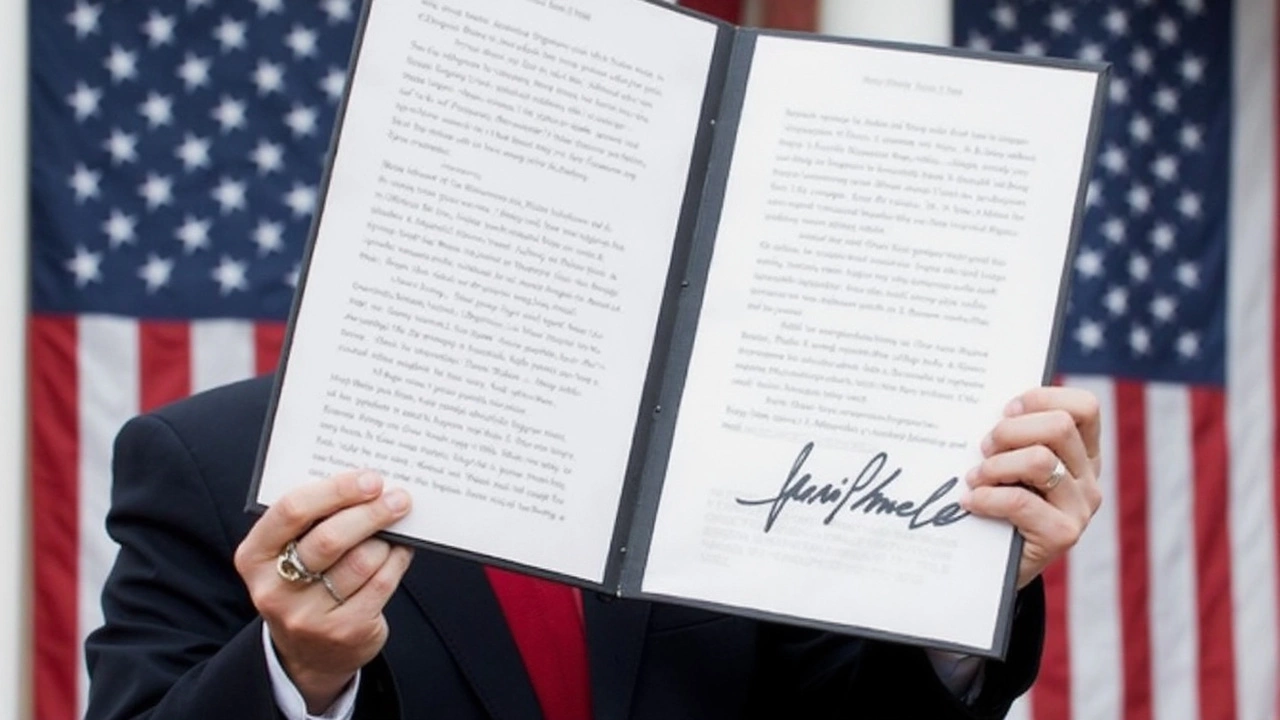

Trump Unveils 'Liberation Day' Tariffs Impacting 150 Nations, Sparking Market Reaction

Posted by Daxton LeMans On 8 Apr, 2025 Comments (0)

Donald Trump announces a broad tariff initiative affecting over 150 countries, to be enacted by April 2025. Aimed at bolstering domestic industries, these tariffs impose varying rates, with Vietnam and Sri Lanka among the highest at 46% and 44% respectively. While some hail the economic boost and job creation, others caution about potential disruptiveness to global trade flows.