US Manufacturing: What’s Happening Right Now?

America’s factories are humming, but the rhythm keeps changing. Production numbers are climbing after a dip last year, driven by strong demand for cars, electronics and medical gear. At the same time, manufacturers are juggling new tech, tighter labor markets and shifting trade rules. If you run a plant or just follow the sector, knowing the current pulse can help you stay ahead.

Automation is no longer a buzzword; it’s on the floor. Robots, AI‑driven quality checks and smart sensors are cutting errors and boosting speed. Small shops are buying modular machines that you can re‑program in minutes, while big players invest in fully integrated production lines that talk to each other. The result? Faster turn‑around and lower waste, which translates to better margins.

People power remains the biggest variable. The skills gap is real – there are fewer workers who know how to program a CNC machine or maintain a robotic arm. Companies are answering with on‑the‑job apprenticeships, partnerships with community colleges, and even VR training modules that let employees practice without stopping the line. Investing in people now pays off later when the next tech upgrade lands.

Key Challenges Facing US Factories

Supply‑chain hiccups still bite. Even a short delay in steel or semiconductor deliveries can halt an entire assembly line. Manufacturers are learning to hold strategic inventory and source from multiple suppliers to buffer against future shocks.

Material costs are climbing faster than prices you can charge. Copper, aluminum and rare‑earth metals have seen record spikes, squeezing profit margins. Some firms are switching to alternative alloys or redesigning products to use less of the pricey stuff.

Regulations around emissions, safety and data privacy are tightening. While they push the industry toward greener, safer operations, compliance adds paperwork and investment. The key is to treat these rules as a roadmap for innovation rather than just a cost center.

Where the Growth Opportunities Are

Reshoring is gaining momentum. Companies that once shipped everything overseas are bringing critical parts back to the US to cut lead times and avoid tariff surprises. This creates demand for domestic suppliers and opens new jobs in regions that lost factories decades ago.

Advanced materials like carbon‑fiber composites and bio‑based plastics are opening niche markets. Manufacturers that can produce these at scale will capture premium prices, especially in aerospace, automotive and consumer goods.

Digital twins – virtual copies of physical assets – let factories test changes before they hit the floor. Coupled with real‑time data analytics, they uncover inefficiencies you’d miss just by looking at the line.

So, what can you do right now? Start by mapping where your biggest bottlenecks sit and ask if a simple sensor or a short‑term training program could fix them. Look for local suppliers who can step in if a global partner falters. And keep an eye on policy updates – a new tax credit for green equipment could offset your upgrade costs.

US manufacturing is at a crossroads of tech, talent and policy. By staying curious, investing wisely and leaning into new partnerships, you can turn today’s challenges into tomorrow’s competitive edge.

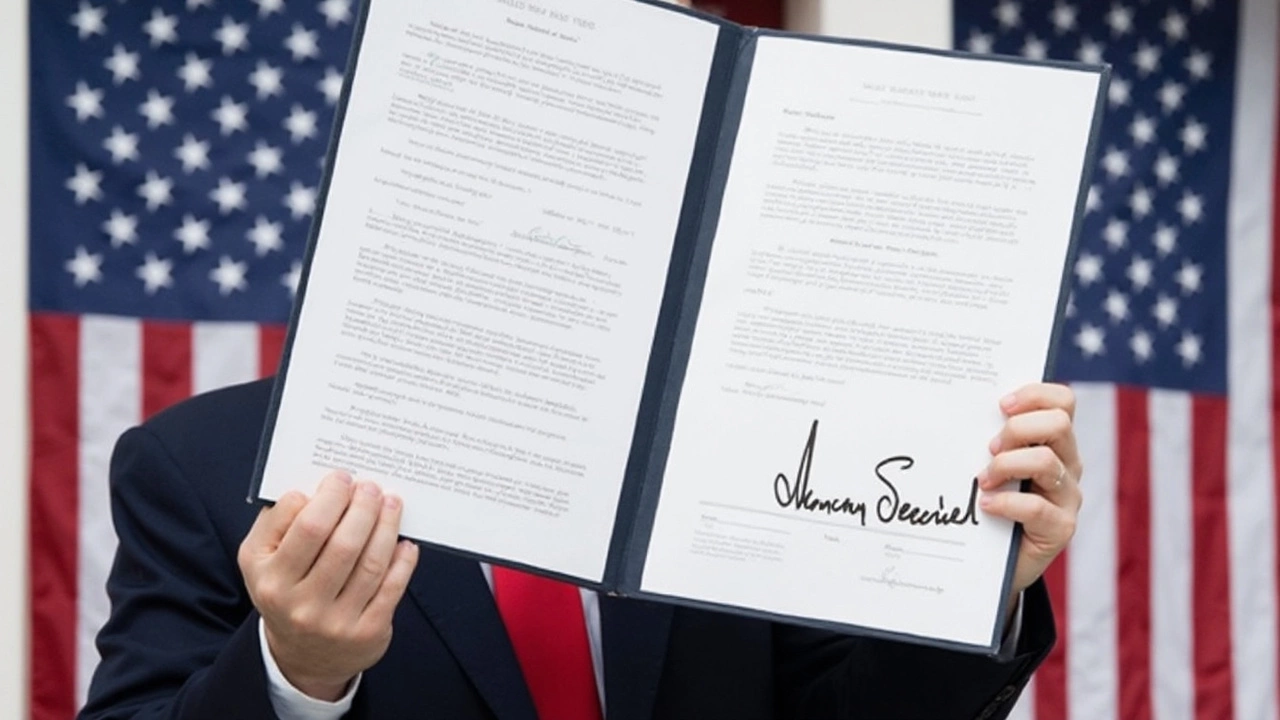

Trump's New Tariffs Shake Global Markets, Spark Debate Over US Trade Strategy

Posted by Daxton LeMans On 8 Apr, 2025 Comments (0)

President Donald Trump has introduced 10% tariffs on 190 countries, with a notable 20% for the EU, aiming to fix trade deficits. While intended to rebuild US manufacturing, these measures have caused significant global market disruptions and invited criticism for potential economic instability. Critics question the tariffs' logic, citing risks to US workers, and highlight potential issues if geopolitical tensions over Taiwan's semiconductors escalate.