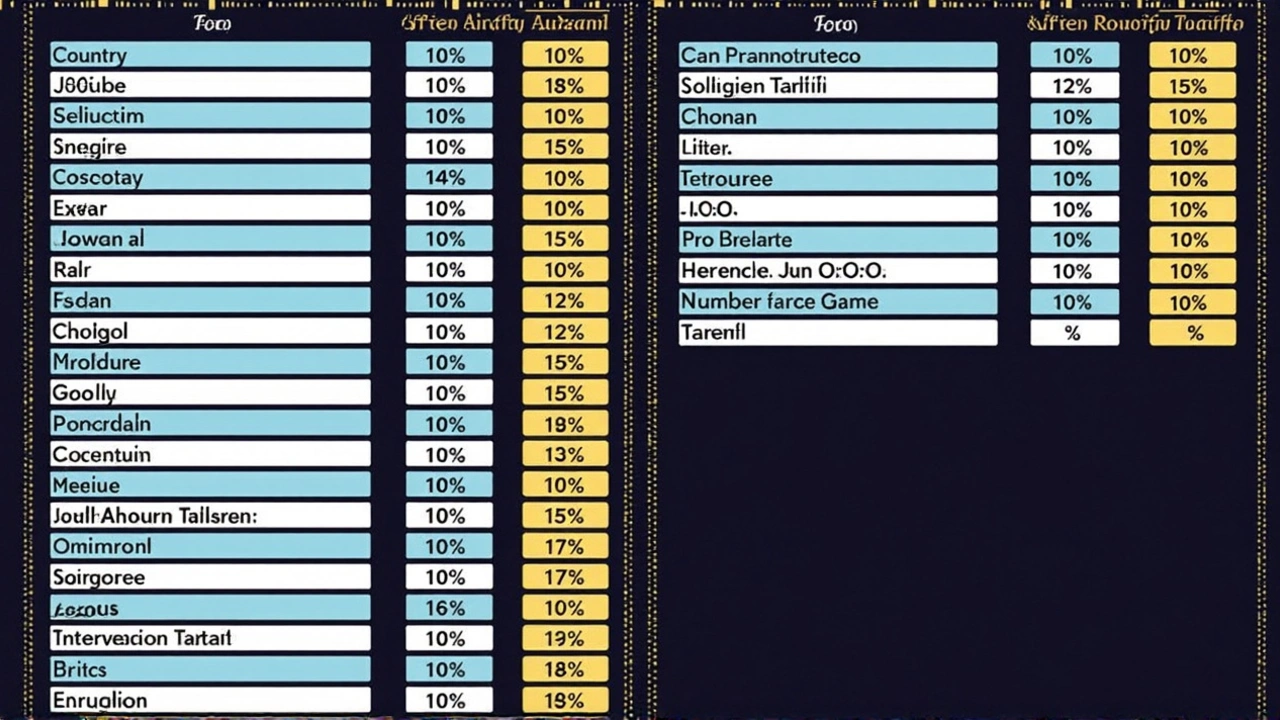

President Donald Trump has set off waves in the global economy with his sweeping new tariffs, targeting 190 nations and territories. At the heart of his plan is a 10% baseline tariff, with the European Union getting slapped with a hefty 20% rate. These tariffs, set to be reciprocated starting April 9, are Trump's bid to rectify trade deficits he sees as damaging to the U.S. economy. China, too, finds itself in the crosshairs of these measures.

The idea here is pretty straightforward, at least from Trump's perspective. He believes these tariffs are 'medicine' needed to address the perceived trade imbalances. But not everyone is buying that narrative. Critics are concerned, warning that the plan could send prices soaring and stifle innovation. Representative Ro Khanna of California didn't mince words, dismissing the tariffs as 'economically ignorant' and pointing out their nationalistic overtones.

Impact on Global Markets

The financial world has already started feeling the tremors. European stock exchanges have dipped to lows not seen since the height of the COVID-19 pandemic, and Asian markets aren't doing any better. The tariffs threaten to disrupt finely tuned supply chains, which could have wider consequences than Trump might anticipate.

Some European countries, like the Netherlands and Belgium, are perplexedly finding themselves among those affected by these tariffs. This is despite their favorable trade balances with the U.S. Critics argue that Trump's simplification—basing tariffs on a calculated trade deficit against total imports—doesn't tell the whole story and could hurt American consumers and workers.

Representative Chris Deluzio from Pennsylvania is among those calling for a more nuanced approach. He insists that a chaotic tariff strategy won't cut it and that targeted trade policies need to go hand in hand with smart industrial investments.

Geopolitical Ramifications and Risks

Beyond the immediate economic impact, there's a geopolitical angle to Trump's tariffs. Analysts like Ben Thompson are pointing to Taiwan's significance as a key player in the semiconductor industry. Taiwan's TSMC is crucial, being the world's leading semiconductor manufacturer. The prospect of a Chinese move on Taiwan could freeze tech supply chains globally, causing economic disruptions that make current shocks look small by comparison.

These tariffs mirror a more extensive anti-globalization sentiment resonating, particularly in areas like the Rust Belt. Many in these regions feel left behind by previous trade deals like NAFTA and China's entry into the World Trade Organization, which they blame for the loss of manufacturing jobs.

In the end, Trump's approach reflects his view of a 'broken' trade system that he believes needs a shake-up. But opponents aren't convinced. They want to see more focused policies, arguing that blanket tariffs may do more harm than good. The debate over these tariffs is just getting started, and their long-term impact remains to be seen.